Tenant interviews, also known as tenant screenings, are sessions that landlords and property owners conduct to help them find the best residents to fill their vacancies. In a way, tenant interviews are like going on a date before committing to a relationship—you have to get to know each other first. For example, if you have a no-smoking policy, your property may not be the best fit for someone who smokes and vice versa.

Conducting a thorough tenant screening can help you identify issues before the tenant signs a contract. To help you find the best renters for your property, let’s review some common red flags that landlords need to look for during tenant interviews.

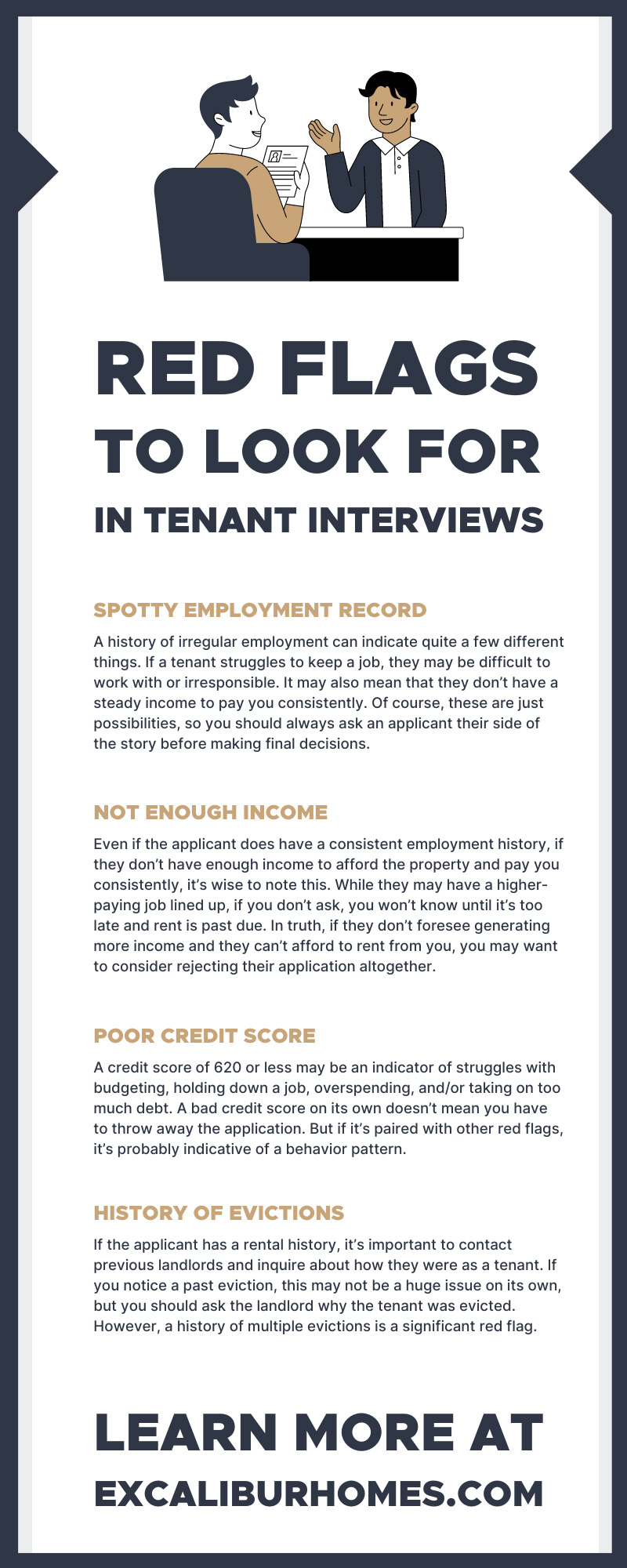

Spotty Employment Record

A history of irregular employment can indicate quite a few different things. If a tenant struggles to keep a job, they may be difficult to work with or irresponsible. It may also mean that they don’t have a steady income to pay you consistently. Of course, these are just possibilities, so you should always ask an applicant their side of the story before making final decisions. However, if you find other red flags in tandem with a spotty employment record, it may be a sign of issues with responsibility, dependability, and finances.

Not Enough Income

Even if the applicant does have a consistent employment history, if they don’t have enough income to afford the property and pay you consistently, it’s wise to note this. While they may have a higher-paying job lined up, if you don’t ask, you won’t know until it’s too late and rent is past due. In truth, if they don’t foresee generating more income and they can’t afford to rent from you, you may want to consider rejecting their application altogether.

Poor Credit Score

A poor credit score is another indicator that the applicant may not be the most responsible or have the financial resources to rent from you. Not only that, but a tenant must first consent to a credit check, and if they don’t consent, they may have something they’re trying to hide. A credit score of 620 or less may be an indicator of struggles with budgeting, holding down a job, overspending, and/or taking on too much debt. Again, a bad credit score on its own doesn’t mean you have to throw away the application. But if it’s paired with other red flags, it’s probably indicative of a behavior pattern.

History of Evictions

If the applicant has a rental history, it’s important to contact previous landlords and inquire about how they were as a tenant. If you notice a past eviction, this may not be a huge issue on its own, but you should ask the landlord why the tenant was evicted.

However, a history of multiple evictions is a significant red flag. While you should still contact those previous landlords and get everyone’s side of the story, it’s hard to excuse multiple evictions, especially if they’re consecutive.

Poor Reviews From Previous Landlords

Even if the applicant doesn’t have past evictions, you should always get references from previous landlords to get the full scoop on a prospective tenant. By contacting previous landlords, you can get answers to the following questions:

- Were they able to pay rent on time?

- Were they noisy during quiet hours?

- Were they respectful of the property?

- Did they adhere to the lease agreement and policies?

If the news isn’t so good, you’ll want to look further into these things, especially if the reviews are bad across the board.

Inability To Provide Reliable References

On the topic of landlord references, an applicant should be able to provide at least two reliable, professional references. While in some cases, a younger applicant may not have a rental history or a very long employment history, they should have someone that can vouch for them. Whether an employer, pastor, volunteer organizer, or dorm manager, their references shouldn’t just be friends or family members. If a tenant only provides you with personal references rather than professional ones or can’t give you any references at all, they may have something they’re trying to hide.

Dishonest or Inaccurate Application Information

When you run a credit check, the report should give you the applicant’s identifying information that you can then cross-reference with the rest of their application. Check their address, phone number, social security number, name, and other given information. If any information is inaccurate or doesn’t match, you need to bring this to the applicant’s attention. While the issue could be as simple as a typo, an applicant could be trying to hide their identity, which is never a good sign.

Minor Red Flags To Watch Out For

On their own, the above red flags may not be enough to make a final decision about a tenant. However, there are a few subtler red flags that, when combined with other major issues, can help you decide whether to accept their application. For example, if a tenant shows up late to interviews, is aggressive, reactive, hesitant to share information, or can’t follow simple instructions, there are some personality flaws at play. Of course, everyone has their own set of quirks. However, if something makes you uneasy, or if you feel like you, your property, or your neighbors may suffer, you should pay close attention to the concerning characteristics.

In truth, the most important red flag to look out for in a tenant interview is anything that doesn’t sit right with you. Your gut instincts can guide you well, and while you shouldn’t refuse to rent to someone solely based on a feeling, your instincts can tell you when to further investigate.

If you need help finding tenants or conducting the interview process, let Excalibur Homes help. We’re a property management company located throughout the South, and if you’re in the area, we can put you in touch with one of our Tampa property managers. Let us use our professional knowledge and experience to help make your life as a property owner much easier.