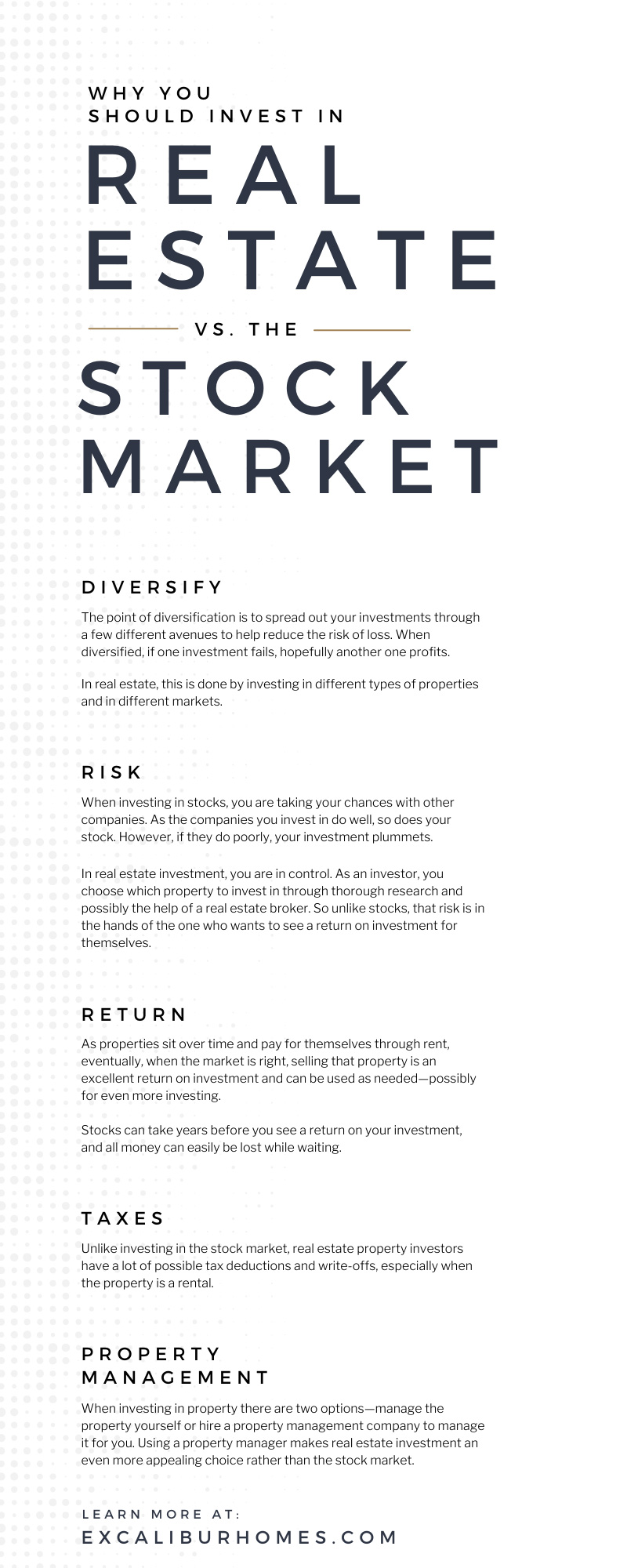

When hearing the word investment, real estate is often the last to come to mind. The stock market, however, is usually the first. Both serve their purpose and are a way to invest, but security and a greater chance of return on investment are just two of the reasons why you should invest in real estate rather than the stock market.

Diversify

It is a word we often hear thrown around in the world of investment. Diversify simply means to not put all of your eggs in one basket.

The point of diversification is to spread out your investments through a few different avenues to help reduce the risk of loss. When diversified, if one investment fails, hopefully another one profits.

In real estate, this is done by investing in different types of properties and in different markets.

A condo in the city is a different investment than a single-family home in a small town or a commercial property. Even flipping houses is a form of investment. All have their pros and cons, but all are real estate investment possibilities.

Although you can also diversify in the stock market, the risk is greater and each stock is very different. In real estate, once a profit is made, it is easier to see which property would next suit your portfolio the best.

Risk

When investing in stocks, you are taking your chances with other companies. As the companies you invest in do well, so does your stock. However, if they do poorly, your investment plummets. Your money is in someone else’s hands and you have no control over how the company operates or what decisions are made.

It often turns out well, but if it does not, the frustration can run high as investment money is lost.

In real estate investment, you are in control. As an investor, you choose which property to invest in through thorough research and possibly the help of a real estate broker.

The beauty of real estate is that more than likely you have lived around it all of your life and probably gone through the buying and selling process before. Familiarity is a benefit of real estate investment. Whereas with stocks, there can often be anxiety in the unknown.

Once the property belongs to you, you are now responsible for it and that is a positive. Upkeep, maintenance, and improvements lie on your shoulders as the owner, just as if you were leading a company.

So unlike stocks, that risk is in the hands of the one who wants to see a return on investment for themselves. This is the first step in reducing risk, simply because the investor is relying on no one else but the market and themselves.

Return

The word every investor cares about—return. Getting the greatest return on investment is the ultimate goal.

When owning property and leasing it out, immediate cash flow is a great possibility. If not immediate as you use it toward paying down a mortgage, at least there is a safe plan and you know the cash flow is coming.

As properties sit over time and pay for themselves through rent, eventually, when the market is right, selling that property is an excellent return on investment and can be used as needed—possibly for even more investing.

Stocks can take years before you see a return on your investment, and all money can easily be lost while waiting.

Taxes

Unlike investing in the stock market, real estate property investors have a lot of possible tax deductions and write-offs, especially when the property is a rental. This alone is a great reason as to why you should invest in real estate rather than the stock market.

Operating expenses to keep the property going, repairs, mortgage interest, and property taxes are all deductible when managing a property. Basically, if it is a cost of managing the property, it may be a deductible.

When investing in the stock market, there are very few possible deductions, but of course, taxes to be paid on gains.

Use of Property

A wonderful bonus of real estate property investment is an ability to invest in something you can put to use at a later time.

Unlike stocks, property is a tangible asset you can physically use after it has made you a profit. Invest in a property in an area you would like to retire to, allow the rent to be a supplemental income for years, and then enjoy retirement with no mortgage.

Passive Income

Unlock stocks which offer unclear financial returns, real estate investment has the ability to create a passive income for you when rented out.

Having a steady stream of income in an amount you can count on every month increases the chances of a well-managed budget and easier planning for the future.

Property Management

When investing in property there are two options—manage the property yourself or hire a property management company to manage it for you.

Using a property manager makes real estate investment an even more appealing choice rather than the stock market.

Real estate is pretty straightforward, familiar, and easy to understand. When managed by a management company it also becomes a passive and steady income that requires little attention from you.

Excalibur homes offers complete investment property management services for Atlanta, GA and all surrounding areas.

Personal Choice

As with most things in life, where you choose to make investments is a personal choice in the end. Factors such as income and cash availability will impact the decision.

Your own personality even plays a role and should be considered when investing. The anxiety that can come with the risk of investing, and the way it affects your life may be the final determining factor when choosing a form of investment.

No matter what pros and cons are discovered as you plan out your investments, it is important to invest in a way that makes you comfortable. If your gut says one way will work better for you than another, go with your gut.