While investing in real estate is a great way to increase your supplemental income, it takes a little financial know-how to do it right. You can save hundreds, if not thousands of dollars when the time comes to file taxes if you know all the deductions you’re allowed to make. Here’s our complete guide to investment property taxes.

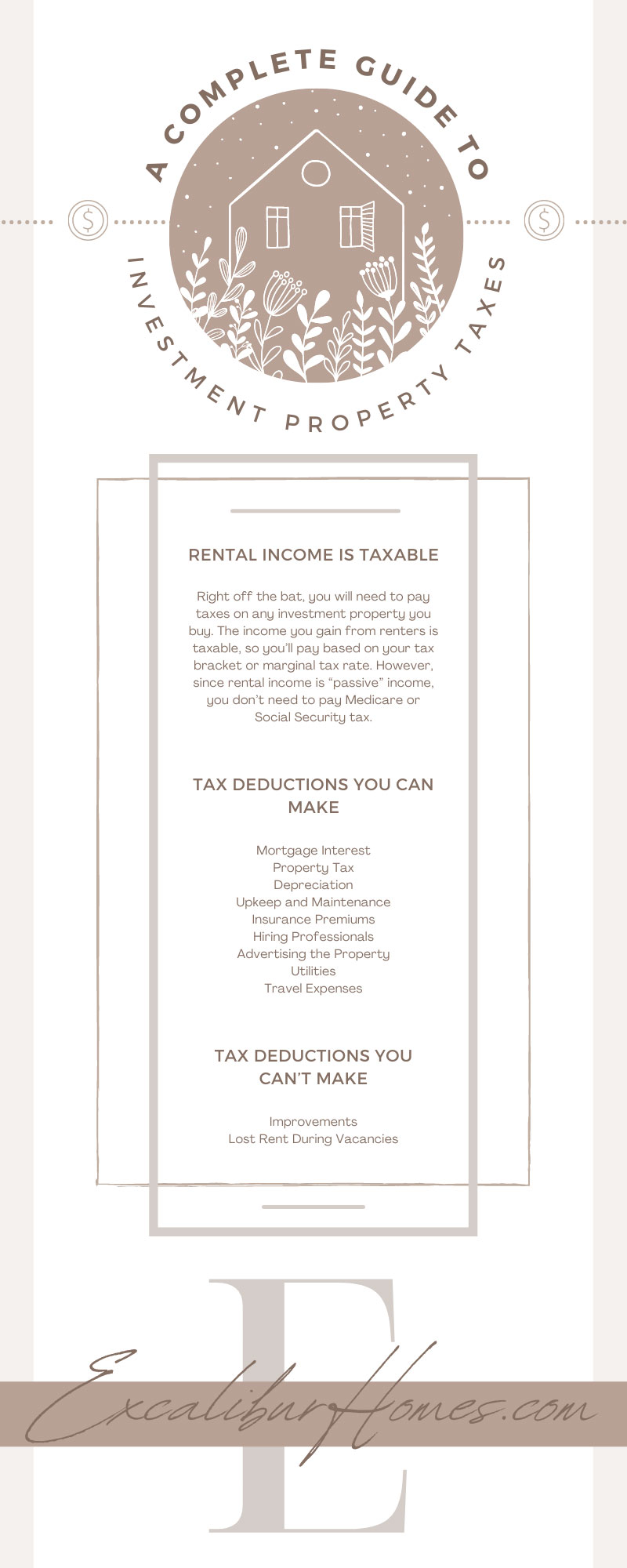

Rental Income Is Taxable

Right off the bat, you will need to pay taxes on any investment property you buy. The income you gain from renters is taxable, so you’ll pay based on your tax bracket or marginal tax rate. However, since rental income is “passive” income, you don’t need to pay Medicare or Social Security tax.

That’s seven to eight percent of your rental income that you get to keep, which isn’t true for “active” income, like the money you make at your day job.

You should also familiarize yourself with state and local income taxes because you’ll generally need to pay those on rentals. This is especially true in popular destinations, as local governments hope to collect extra money in tourism revenue.

Tax Deductions You Can Make

The good news is that there are quite a few operating expenses you can deduct to save lots of money annually. A rental property is like a business, so several of your deduction options are the same as those offered to businesses throughout the country.

Mortgage Interest

While you can’t deduct mortgage interest on your residential home, you can deduct it for a rental property. This is excellent if you took out a home loan to finance your rental since accrued interest is all tax-deductible.

Remember, if you do a cash-out refinance, you’ll need to remember how much cash you use for purposes unrelated to the rental. Any money you spend to pay off consumer debt isn’t deductible.

Property Tax

Your rental property tax is determined by multiplying the property’s assessed value by the local tax rate. This ongoing expense is, mercifully, tax-deductible! The more you grow your property holdings, the more property taxes you’ll be responsible for, so it’s a good thing you can deduct them every year.

Depreciation

Properties decline in value over time, and you can deduct the depreciated value. All you need to calculate depreciation is your cost basis and the useful life span of the property.

To figure out your cost basis, add up the original investment you made in the property subtracting the value of the land the property is on. Then, add up the legal costs associated with the purchase, title insurance costs, property survey costs, recording fees, transfer taxes, and debts you assumed from the seller. Finally, take that total and divide it by 27.5. Now you have your deductible depreciation value!

You can only deduct depreciation from the date that the property is rent-ready. If you buy a dilapidated house and spend six months fixing it up, you can’t calculate depreciation until it’s finished.

Upkeep and Maintenance

Keeping a rental property requires quite a bit of ongoing maintenance. All these costs are deductible expenses, including repairs, preventative maintenance, and cleaning costs. However, while repairs and maintenance are deductible, improvements to the property are not—we’ll discuss that in more detail later.

Insurance Premiums

Insurance that protects your finances and your property from harm is deductible. You can deduct up to one year of insurance premiums during the year that you pay them. You aren’t allowed to prepay premiums from future years to increase your deductions, however.

Your location may dictate the need for specific coverage, like flood or earthquake protection—regardless of the insurance type, it’s deductible!

Hiring Professionals

Experts can help save you money by managing the paperwork, finances, and upkeep of your rental, and these services are tax-deductible. If you enlisted the help of a real estate agent, lawyer, accountant, tax preparer, or property management company, you’ll enjoy the savings they provide you and reduced taxes.

Time is money, so you should seriously consider hiring a property management company to take day-to-day upkeep problems off your plate. They’ll handle everything from finding tenants to tracking them down for late rent payments.

Advertising the Property

There are dozens of online services that let you advertise your rental, and very few of them are free. Any money you spend advertising your property to potential renters is tax-deductible, whether you make an online posting or put an ad in the paper.

Utilities

If you’re among the incredibly generous landlords that pay for their tenants’ utilities, these expenses are tax-deductible!

Travel Expenses

If you don’t live close to your rental property, don’t worry. The travel expenses from your commute, including gas and overnight costs are deductible when you make the trip to manage your property. You have the option to deduct either your actual expenses or the standard mileage rate from the IRS: 56 cents per mile.

Tax Deductions You Can’t Make

With everything that’s deductible, you may be wondering if there’s anything that doesn’t make the list! There are a few things you should know to avoid nasty surprises on Tax Day.

Improvements

Confusingly enough, while maintenance and repairs are deductible, improvements to the rental are not. You can fix a leak in the roof and write it off, but as soon as you upgrade the roof to a higher-quality material, you can’t deduct it. Additionally, travel costs to the property to make improvements aren’t deductible, either.

Lost Rent During Vacancies

If your property sits vacant for a few months, you’re not able to deduct the lost rent that you would have earned if the property were occupied. Similarly, if a tenant ever stops paying rent but maintains residency in the property, you can’t deduct the unpaid rent. Luckily, you don’t owe income tax on the rent you weren’t paid, so this works out!

Now that you understand this complete guide to investment property taxes and deductions, you may want to consider diversifying your portfolio. It’s a good idea to own property in several different locations, and Georgia’s real estate market is booming—if you’re looking for investment properties in Atlanta, we can help!