Opening a business of any kind takes money—a lot of it. Understandably, business owners of all types and backgrounds are always looking for different ways to spend smart, save money, and protect their assets. The best way to do that is to create a separate legal entity to save on taxes and limit your liability. One of the most popular ways for real estate investors to protect their business from losses is by creating an S corporation for rental properties. Let’s go through what an S corporation is and how to start one so you can decide if opening an S corporation is right for you.

What Is an S Corporation?

In the broadest terms, a corporation is a legal entity owned by shareholders that the International Revenue Service (IRS) taxes as a corporation. The shareholder has a limited amount of legal and financial liability placed on them when forming a corporation as opposed to a partnership. This liability limitation means that if someone were to sue the corporation, the owner’s personal assets aren’t subject to collections. S corporations allow shareholders to report any income and losses on their personal tax returns. In turn, the IRS only taxes shareholders on the personal level rather than on the personal and corporate level so they can avoid double taxation.

How Is It Different From an LLC?

The definition of an S corporation can leave some more than a little confused, and understandably so. An S corporation sounds a lot like an LLC, so what’s the difference? A few major ones come to mind.

The biggest difference between the two is that, as an LLC, you can choose how the IRS taxes you. The IRS can tax you either as a pass-through entity or as a corporation. S corporations are a little stricter. You have a limit on who can be a shareholder and how many shareholders the corporation can have.

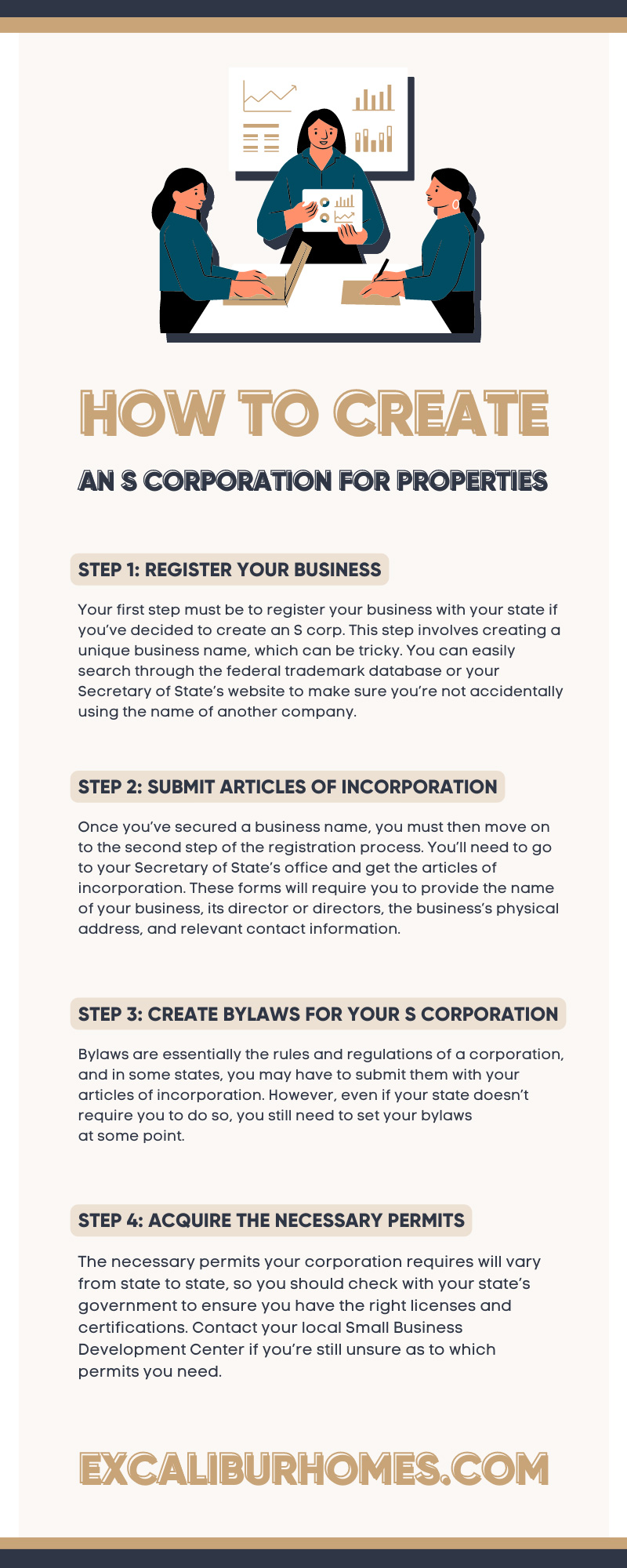

Step 1: Register Your Business

Your first step must be to register your business with your state if you’ve decided to create an S corp. This step involves creating a unique business name, which can be tricky. You can easily search through the federal trademark database or your Secretary of State’s website to make sure you’re not accidentally using the name of another company. You may want to reserve the name you came up with just in case the name is available, and you don’t intend to register your business immediately.

Step 2: Submit Articles of Incorporation

Once you’ve secured a business name, you must then move on to the second step of the registration process. You’ll need to go to your Secretary of State’s office and get the articles of incorporation. These forms will require you to provide the name of your business, its director or directors, the business’s physical address, and relevant contact information.

Step 3: Create Bylaws for Your S Corporation

Bylaws are essentially the rules and regulations of a corporation, and in some states, you may have to submit them with your articles of incorporation. However, even if your state doesn’t require you to do so, you still need to set your bylaws at some point. Your corporation’s bylaws will address the meeting format between shareholders or directors, who has access to documents, shareholder powers and responsibilities, and the process of changing bylaws.

Step 4: Acquire the Necessary Permits

The necessary permits your corporation requires will vary from state to state, so you should check with your state’s government to ensure you have the right licenses and certifications. Contact your local Small Business Development Center if you’re still unsure as to which permits you need. However, rental property owners and real estate investors may want to work with a real estate attorney local to the area to cover all the bases.

Step 5: Obtain an Employer Identification Number

Obtaining an Employer Identification Number (EIN) is incredibly important. It is the business equivalent of a Social Security Number in many ways. An EIN allows you to apply for business licenses and permits, hire employees, and pay federal taxes while keeping your personal and business finances separate. Fortunately, you can easily obtain an EIN by visiting the IRS’s website and applying online.

Step 6: Elect Your Corporation for S Corporation Status

Once you’ve filed all the necessary documents and obtained the right permits, your last step in creating an S corp is to elect your corporation for S corp status. You must file Form 2553 Election by a Small Business Corporation. However, you must do so within two months and 15 days of the tax year. It won’t go into effect until the next tax year if you miss the deadline but the IRS approves your status.

The Pros of S Corporations

Now that you know how to create an S corporation for rental properties, the real question is whether creating an S corporation is right for you. Below, we detail some of the pros and cons to help you decide.

As previously mentioned, one of the major benefits of an S corporation is the limited liability protection and the ability to avoid double taxation. It’s also much easier to transfer ownership to other entities or individuals. Lastly, unlike a C corporation, the IRS does not require S corporations to distribute profits as dividends, as these cash distributions aren’t taxable.

The Cons of S Corporations

The main disadvantage of creating an S corporation for many business owners is how challenging it can be to open and maintain. Shareholders need to have annual meetings and file tax returns. Again, the rules regarding your shareholders are very restrictive. You cannot have more than 100 shareholders, each of whom must be U.S. citizens or permanent residents.

At Excalibur Homes, we know how much work goes into running your rental property business. That’s why our experienced and dedicated property managers work tirelessly to provide you with top-of-the-line property leasing & management services. You can focus on diversifying your portfolio and expanding your business while we care for your property and help you get the most out of your investment.