Investing in a rental property can have great potential for long-term financial gain. However, when it comes time to sell, many investors have questions about the impact of depreciation on their return. How will it affect the sale price? Will it be a loss or a gain? Let’s review everything you need to know about how depreciation may affect your rental property sale.

What Is Depreciation and How Does It Affect Property Value?

Depreciation refers to the decrease in value of an asset over time due to wear and tear, obsolescence, or other factors. In real estate, depreciation is a tax deduction that allows landlords to offset the cost of their property over 27.5 years for residential properties and 39 years for commercial properties.

Each year, you can deduct a portion of the cost of your property from your taxable income until the full cost has depreciated.

While depreciation may seem like a hassle, it has several benefits for real estate investors. First, it reduces your taxable income and your tax liability. Second, it can contribute to a higher annual cash flow since you get a tax break on a portion of your investment. Third, it can serve as a hedge against inflation since the value of your property will increase over time, but you will still be able to deduct the original purchase price.

Note that depreciation also impacts the value of your property if you decide to sell it. When calculating the value of a property, appraisers consider the cost of the land and the cost of the building. The cost of the building is typically calculated by subtracting the total depreciation from the original purchase price. As depreciation increases, the value of the building decreases, which can affect your potential profit when you sell.

Factors That Impact the Amount of Depreciation on a Rental Property

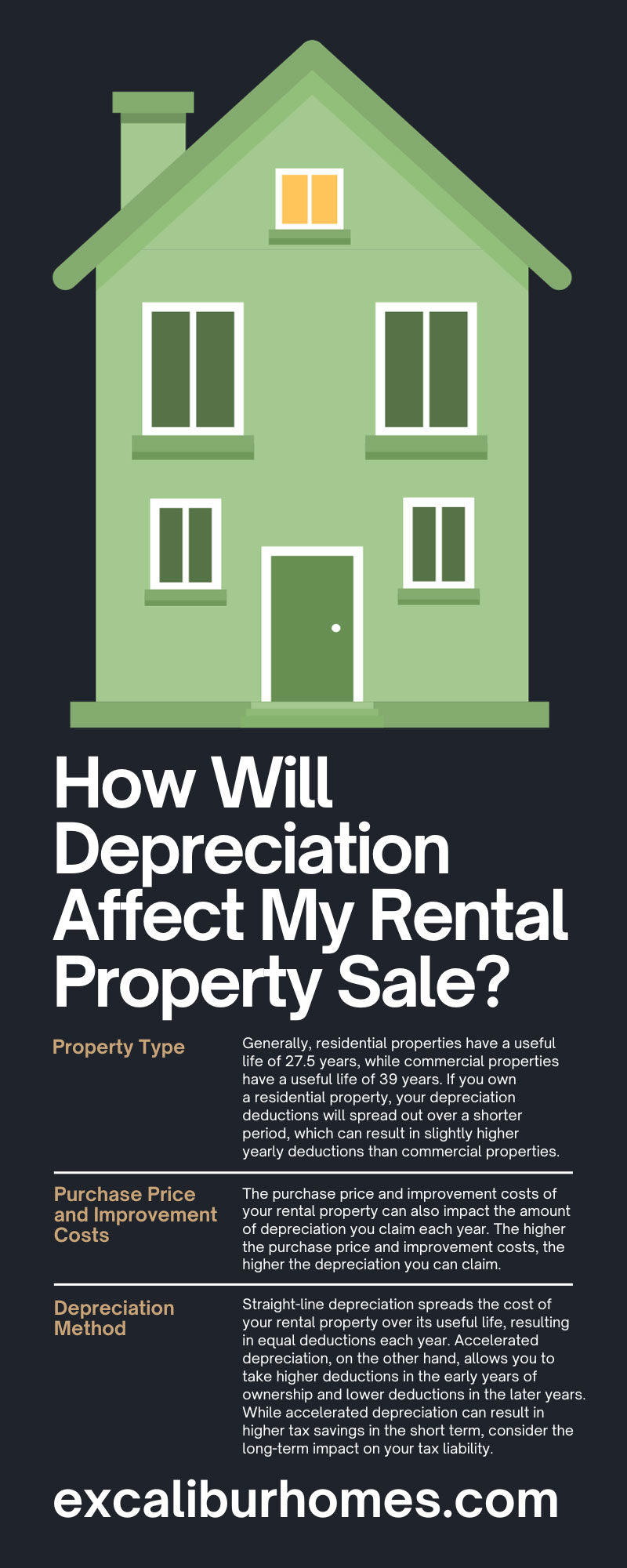

Property Type

One of the most significant factors that can impact the depreciation of your rental property is the type of property you own. There are different depreciation schedules for Residential and commercial properties have different depreciation schedules, and the rate of depreciation varies depending on the property’s useful life. Generally, residential properties have a useful life of 27.5 years, while commercial properties have a useful life of 39 years. If you own a residential property, your depreciation deductions will spread out over a shorter period, which can result in slightly higher yearly deductions than commercial properties.

Purchase Price and Improvement Costs

The purchase price and improvement costs of your rental property can also impact the amount of depreciation you claim each year. The higher the purchase price and improvement costs, the higher the depreciation you can claim.

Note that the IRS has guidelines on what types of improvements can depreciate and over what period. Generally, repairs and maintenance costs cannot be depreciated, while improvements that extend the property’s useful life, such as a new roof or HVAC system, can be depreciated.

Depreciation Method

Another factor that can impact the amount of depreciation on a rental property is the depreciation method you choose. Two methods of depreciation include straight-line and accelerated depreciation.

Straight-line depreciation spreads the cost of your rental property over its useful life, resulting in equal deductions each year. Accelerated depreciation, on the other hand, allows you to take higher deductions in the early years of ownership and lower deductions in the later years. While accelerated depreciation can result in higher tax savings in the short term, consider the long-term impact on your tax liability.

Personal Use

If you personally use your rental property as a vacation home for part of the year, you may not be able to claim depreciation. The IRS has specific rules regarding the use of rental properties for personal use. If you use the property for more than 14 days a year or more than 10 percent of the time it’s rented out, you may not be able to claim depreciation.

Tax Basis

Finally, the tax basis of your property can impact the depreciation you can claim. The tax basis is the original cost of the property plus any improvements minus any depreciation already claimed. The higher your tax basis, the lower your depreciation deductions because the IRS allows you to claim depreciation on the property’s cost basis, not its fair market value.

Calculating the Depreciated Value of Your Rental Property

Determine the Cost Basis and Useful Life of the Property

Calculating the depreciated value of your rental property is important for determining its value and potential profit when selling. Your first step is to calculate the cost basis and determine the useful life of your property.

The cost basis is the original purchase price of the property plus any expenses incurred during the purchase, like closing costs, legal fees, and commissions. This is the starting point for calculating depreciation.

The useful life is the estimated period that the property will be in use and provide income. The IRS provides guidelines for rental properties, which are 27.5 years for residential properties and 39 years for commercial properties.

Determine the Depreciation Rate

You can calculate the depreciation rate by dividing the cost basis by the useful life. This will give you the amount of depreciation you can deduct from your taxes each year. For example, if your rental property cost $300,000 and has a useful life of 27.5 years, your depreciation rate would be $300,000/27.5 = $10,909 per year.

Calculate Accumulated Depreciation

Accumulated depreciation is the total amount of depreciation the property has taken on since it was acquired. To calculate this value, multiply the depreciation rate by the number of years the property has been in service. Let’s say you’ve owned your rental property for 10 years. Using the previous example, your accumulated depreciation would be $10,909 x 10 = $109,090.

Find the Depreciated Value of Your Property

To calculate the depreciated value of your rental property, subtract the accumulated depreciation from the original cost basis. Using the examples above, the depreciated value of your property after 10 years would be $300,000 – $109,090 = $190,910.

Selling a rental property can be a complex process, you should recognize how depreciation may affect your sale. By understanding the basics of depreciation, you can make informed decisions to minimize the impact on your taxes. While you can take several approaches, it’s important to work with a tax professional who can help you navigate the rules and regulations to get the most out of your rental property sale.

If you’re ready to expand your portfolio and purchase a new property or need to manage your current one, contact Excalibur Homes today. We offer rental property management in Atlanta and can connect you with high-quality properties in the area. We’re dedicated to helping investors like you make more while doing less!