The real estate market is an unpredictable one. Demand fluctuates, investments depreciate, interest rates swing, and other unforeseen events and hurdles can put your money and credit at risk. However, the field of real estate investing is also a lucrative one, so what can you do to put your investment on safe grounds?

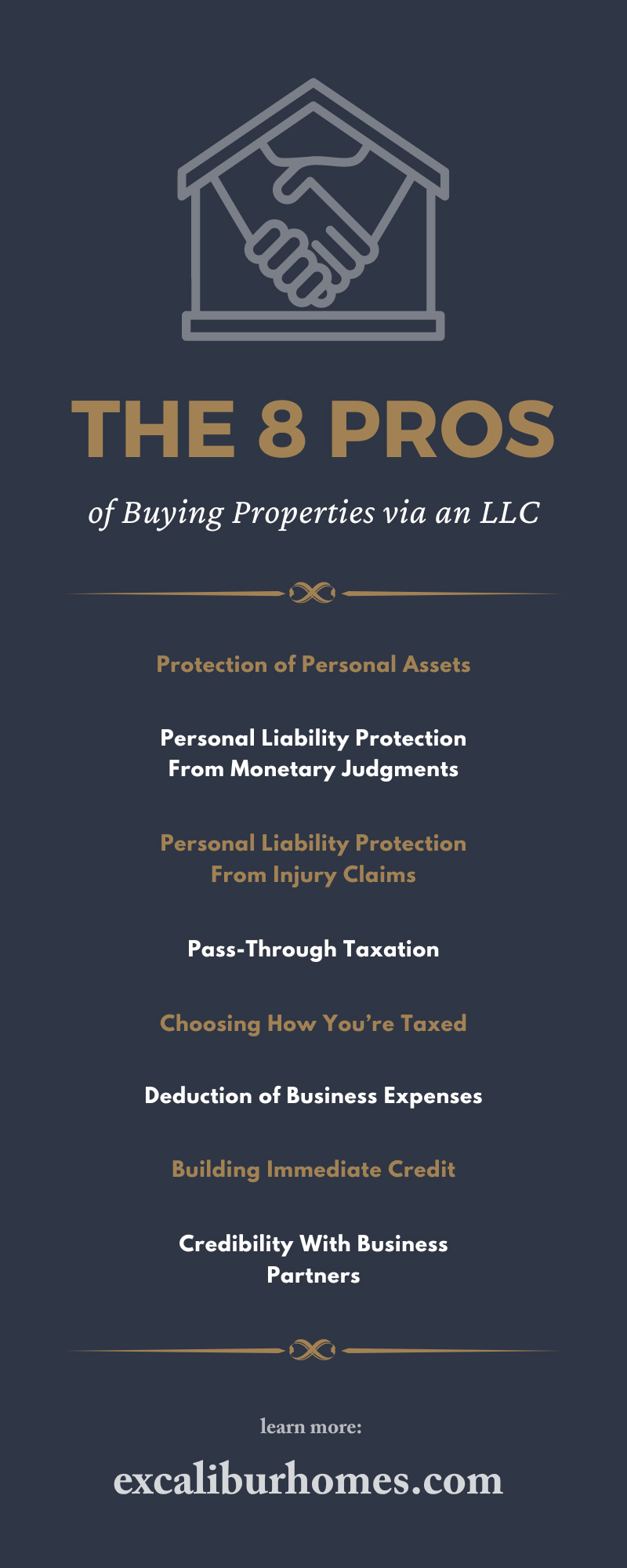

A limited liability company (LLC) is, in simple terms, a business structure that ensures its members are not held personally liable for debts. If you’re unsure about the security of real estate investing but want to capitalize on the market, learn the pros of buying properties via an LLC that make investing safer.

Protection of Personal Assets

Personal assets are things such as your car, home, or other cash equivalents. When you take out a loan, creditors will typically use an asset as collateral in case you don’t make your payments. If you were to stop paying those mortgage payments or suddenly find yourself without the resources to do so, your rental property would foreclose. Plus, you risk having to liquidate personal assets. As we will get into in the next sections, know that forming an LLC protects those personal assets, reducing the natural risks that come with real estate investing.

Personal Liability Protection From Monetary Judgments

In any business or investment, there is always a chance that you make an incorrect financial call or that your property becomes involved in some kind of financial dispute. As we mentioned earlier, joining an LLC means you will not be personally liable. Say, for instance, the demand for rental properties suddenly takes a nose dive right after you invested in an expensive property that should have been lucrative. If you were to invest in the property on your own, your personal assets could be repossessed to pay for the loan you took to buy the property. With an LLC, you don’t have to worry about creditors knocking at your door.

Personal Liability Protection From Injury Claims

Just as an LLC protects your personal assets from monetary judgments, it also protects you from being responsible for personal injustice claims. For example, imagine a flight of stairs on your rental property needs repairs, you forget to call a repairperson, and your tenant falls through a broken step, injuring themselves. Without an LLC, you could find yourself at the receiving end of a serious injury claim, and your insurance can only do so much. However, only an LLC can be named in the lawsuit, meaning only the LLC’s assets—not your personal ones—become subject to collections.

Pass-Through Taxation

An LLC is a type of pass-through entity, which means the business itself does not pay income tax. This is because you can choose for the Internal Revenue Service (IRS) to tax you as a partnership, sole proprietor, or as a C or S corporation. Instead, taxation passes through to each of the owner’s personal tax returns. The IRS would then tax the profits in accordance with each member’s income tax rate. This allows business owners to avoid double taxation, in which the IRS would tax you at the corporate and personal levels.

Choosing How You’re Taxed

As we mentioned, you can elect for the IRS to tax you as a partnership, sole proprietor, or as a C or S corporation. However, as a C corporation, you run the risk of double taxation; it pays taxes at the corporate level rather than directly through the individual. Although the IRS will tax you at the individual and corporate levels, you’ll be taxed at a much lower corporate rate. Conversely, S corporations, sole proprietorships, and partnerships are not double taxed, meaning the IRS will only tax you once on the personal level. When choosing how you want the IRS to tax you, you should consider your personal income, how much you plan to reinvest, and your overall financial goals.

Deduction of Business Expenses

One of the other tax benefits of forming an LLC is the ability to write off many expenses when you file your income taxes. If you were to solo invest, you could write off many of these expenses, but not on the same level. When you form an LLC, these expenses can fall into two categories: start-up expenses and ongoing operational costs.

Start-up expenses include the costs of equipment, marketing, permits, new-hire training, research, and travel. Essentially, start-up expenses include everything it takes to get a business off the ground. Ongoing operation costs are things like cellphone bills, utilities, rent, supplies, and other costs incurred from day-to-day business. This entails much more than what you might write off to buy the materials to fix the sink in your rental property.

Building Immediate Credit

One of the risks of investing in real estate property on your own is the impact it can have on your credit if things go awry. If you form an LLC and have employees, you’ll need an Employer Identification Number (EIN). This separates your personal and business dealings, establishing and impacting the credit of the business itself rather than your personal credit. This allows you to build good credit quickly so you can apply and qualify for credit lines under your business. This benefits real estate investors who often use personal and business credit profiles for funding.

Credibility With Business Partners

Lastly, one of the most unsung benefits of forming a real estate LLC is the credibility it gives you with other business partners. When contractors and other business partners see how hard you’ve worked to form an LLC, they’re much more likely to trust in your decisions as a business entity. This makes it more likely for contractors and other business partners to work with you and for homeowners to sell to wholesalers under a brand. Overall, it builds a sense of credibility and professionalism you may not be able to achieve as a solo investor.

Fortunately, there are many pros to buying properties via an LLC, allowing investors a safe and lucrative alternative to solo investing. Whether or not you own an LLC, let Excalibur Homes help you make more money for less work. We’re a Nashville rental property management company with dedicated and experienced property managers who will work hard to make buying, owning, managing, and selling your rental property a lot easier.